Mini grid and C&I

- Home

- Mini grid and…

MINI-GRID AND C&I SUB-SECTOR

A solar mini-grid consists of three main systems: production, distribution, and end-user. Some companies offer all these services or one of them. A solar plant is called a solar mini-grid if it produces between 10 kW and 10 MW.

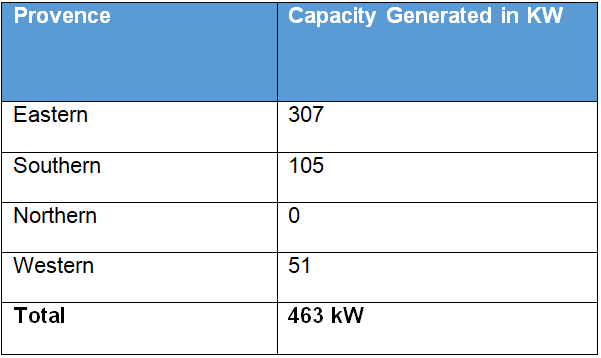

By the year 2020, 11 mini-grid companies reporting to EDCL generated electricity of 463 kW capacity and connected 6,482 households. 6 of the 11 companies use solar PV technology while 5 use hydropower and among the 11 operational companies 9 are EPD members.

Table1: Mini-grid generation capacity per Provence in 2020

In 2016, most of the hydropower plants were originally developed by the Government and handed over to private sector management to increase the private sector contribution to energy generation, to better operate the plants, upgrade them and later connect them to the grid. Mini-grid plants generate power capacity ranging from 11kW – 10MW and other Micro-power plants in the range of 1-10 kW which are either publicly owned, operated by the local communities, or entirely private.

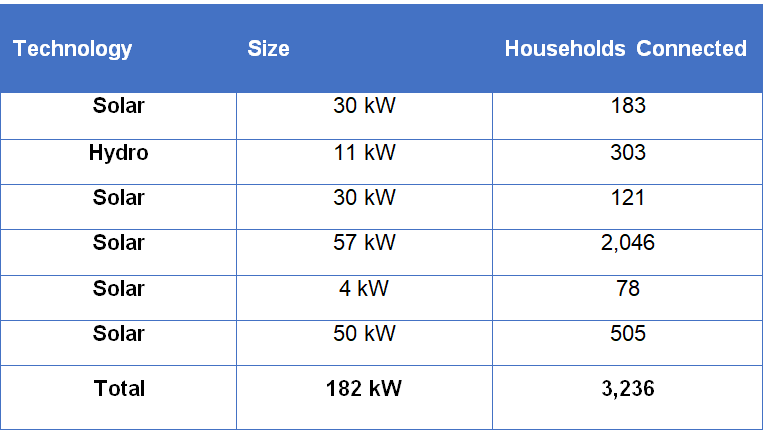

By end of 2019, mini-grids connected 3,236 households across Rwanda, 84 mini-grids have been installed with a total capacity of around 250 kW but managed to produce only 182 kW. These solar and solar hybrid mini-grids maybe DC, AC, or a combination of both. Most mini-grids are AC but rural communities with low power demands may be suited to DC. DC systems tend to have a lower capex per watt, as they require fewer components and do not require expensive inverters. DC mini-grids also have the added benefit of being directly compatible with DC appliances, which also tend to be more energy-efficient. This ultimately allows mini-grid operators to set lower tariffs. On the other hand, AC mini-grids are more expensive because of the use of higher-voltage appliances but facilitate easier connection to the main grid when it arrives at the mini-grid area.

Table2: Mini-grids operational in Rwanda in 2019

Challenges

Rwanda mini-grid developers are ready to scale up, but they are limited by access to concessional capital, access to loan guarantees, high interest rates, large upfront capital and collateral requirements remain as considerable hurdles for potential developers.[1]

Funding programs

To address challenges faced by Mini-grid developers, the Government of Rwanda has set an ambitious target of universal access to electricity by 2024, with 52% of the population to be reached by the grid and 48% of the population by off-grid solutions. It is for this purpose the Government of Rwanda launched a Result Based Financing (RBF) through Rwanda Development Bank (RDB) to provide local currency financing to Mini-grid developer under Window 3 program. This window provides direct financing to eligible mini-grid developers to finance up to 70 percent of construction of renewable-energy based mini-grid systems. The REF may provide ‘bridge loan’ financing until grant funding from existing RBF programs becomes available, as well as long-term financing beyond commissioning. REF loans are used to bring a mini-grid project to commissioning, when RBF becomes available from other donor-funded programs.

Since its existence under window 3 RBF BRD has received 3 loan proposals from Mini-grid developers out which 1 has been approved. Out of RWF 2,309,223,812 fund request, RWF 62,301,570 were approved for Energy and Supply Construction (ESC) Ltd Rubaba mini-grid (20kw) and 166 households and other institutions were connected by the plant.

Market revenue projection

The Rwanda Mini Grid Market revenue is projected to grow at a Compound Annual Growth Rate (CAGR) of over 20% in the coming five years (2021-2026).[2] The market is anticipated to witness a period of slow down on account of Covid-19 triggered global recession, however, the situation is anticipated to improve post 2021 on account of increasing power demand and ambitious government targets of 100% electrification by 2024. Initiatives such as National Strategy for Transformation and RBF window 3 easy financing for mini grid are anticipated to aid the growth of the market in coming years.

[1] Power Africa Stakeholder Consultation, March 2021.

[2] Rwanda Mini-Grid Market Report2021, 6W Research

Some of the Key Players in the solar sub-sector

![]()

![]()

![]()

![]()